When a brand-name drug’s patent runs out, the market doesn’t just change-it collapses. Prices drop by 80% or more. Sales vanish overnight. And if you’re the company that spent $2 billion developing that drug, you’re staring at a cliff with no safety net. The question isn’t whether generics will come-it’s when. And predicting that moment isn’t guesswork. It’s a high-stakes science built on patents, legal battles, FDA paperwork, and game theory.

Why Timing Matters More Than You Think

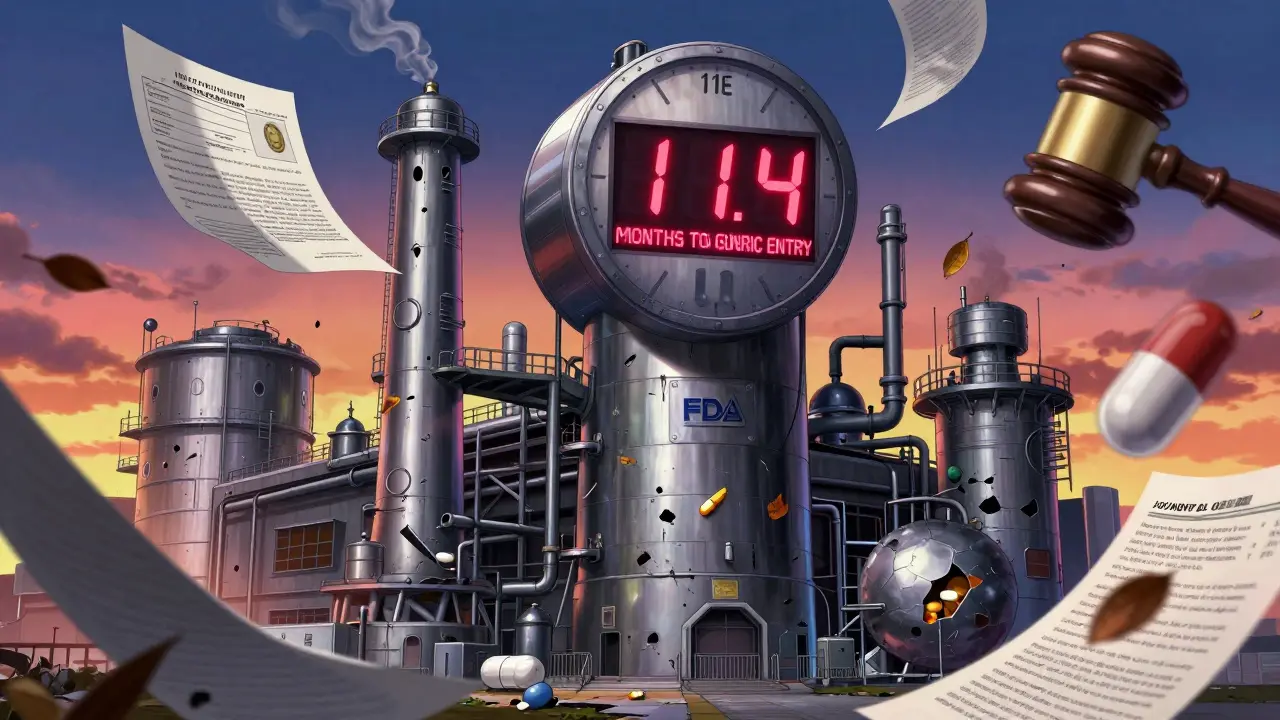

Most people think generic drugs hit the market the day a patent expires. That’s not even close to true. The average delay between patent expiration and first generic entry is 11.4 months. For some drugs, it’s over two years. Why? Because the system is designed to be messy. The 1984 Hatch-Waxman Act created the pathway for generics by letting companies file Abbreviated New Drug Applications (ANDAs). But it also gave brand companies tools to delay competition. Patents don’t just protect the active ingredient-they cover delivery methods, dosages, even packaging. A single drug can have 50+ patents layered on top of each other. That’s called a “patent thicket.” Take Humira. Its core patent expired in 2016. But because AbbVie filed over 130 follow-up patents, generic versions didn’t launch until 2023. That’s seven extra years of monopoly pricing. That’s $20 billion in lost generic savings. If you’re forecasting entry, you don’t just look at the main patent. You map every single one.The Data That Actually Predicts Entry

You can’t forecast generic entry with just a calendar. You need real-time data from five critical sources:- FDA Orange Book: Lists every patent and exclusivity period tied to a drug. Updated weekly. Missing one patent means your forecast is wrong.

- ANDA submissions: When a generic company files, it must declare whether it’s challenging any patents. That’s called a Paragraph IV certification. About 78% of first generics file this way.

- Patent litigation records: If a generic challenges a patent, the brand company usually sues. That triggers an automatic 30-month stay on approval. On average, litigation delays entry by 18.7 months.

- Drug approval timelines: The FDA takes 38 months on average to approve an ANDA. But if the drug is complex-like an inhaler or injectable-that time jumps to 52 months.

- Market size: Drugs making over $1 billion a year attract generics faster. The bigger the prize, the sooner competitors show up.

How Generics Actually Win: The Price Cascade

The first generic doesn’t just enter. It drops the price by 39% overnight. The second generic slashes it another 15%, bringing prices down 54% below brand levels. By the sixth generic, prices are 85% lower. That’s not theory-it’s what happened with Lipitor after its patent expired in 2011. But here’s the catch: not all drugs follow this pattern. Biologics-like Humira or Enbrel-are different. They’re made from living cells, not chemicals. So generics for them are called biosimilars. And they’re harder to make. Approval takes 12-18 months longer. Price drops are slower. After three biosimilars enter, prices fall only 25-35%. Why? Because doctors are hesitant to switch. Insurance companies often don’t allow substitution. And the manufacturers of biologics fight hard to keep patients on their brand. Even more confusing: sometimes, the brand company launches its own generic. That’s called an “authorized generic.” It happens in 41% of cases. And it’s not predicted by most models. The brand keeps the revenue stream, but at a lower price. It’s a way to steal market share from real generics. If you don’t account for authorized generics, your forecast is useless.

The Hidden Delays Nobody Talks About

You’d think once the patent expires and the FDA approves the generic, it’s game over. But there are secret delays built into the system.- Product hopping: The brand company switches patients to a new version of the drug just before the patent expires. Maybe it’s a new pill shape, or a once-daily version. The FDA allows it. Patients are moved over. Generics can’t copy the new version until it’s off-patent. This tactic extends exclusivity by 18-24 months in 63% of top-selling drugs.

- Citizen petitions: A brand company files a formal complaint with the FDA, claiming safety or efficacy issues with the generic. The FDA must respond. On average, this delays entry by 7.1 months.

- REMS programs: Risk Evaluation and Mitigation Strategies are safety programs. If a drug has a REMS, generic manufacturers must prove they can meet the same safety protocols. That adds 14.3 months on average.

- Pediatric exclusivity: If a brand company tests a drug in children, they get an extra 6 months of market protection. It’s legal. And it’s in 28% of cases.

What Works in 2026: The New Rules

The game changed in 2023. The FDA launched the Competitive Generic Therapy (CGT) pathway. If a drug has little or no generic competition, a company can get 180 days of exclusivity just for filing an ANDA. That’s a huge incentive. But it’s also a wildcard. It’s making more companies enter earlier-and it’s messing with old models. Then there’s the Inflation Reduction Act. Starting in 2026, Medicare will negotiate prices for 10 high-cost drugs each year. That includes some that are about to go generic. Analysts think this could reduce price erosion by 15-20% for those drugs. Why? Because if the government is already forcing lower prices, generics might not need to compete as hard. That’s a new variable no model fully accounts for yet. State laws add another layer. California’s 2022 Substitution Act lets pharmacists switch patients to generics more easily. Other states don’t. So in California, prices drop faster. In Texas, they don’t. Most forecasting tools use national averages. That’s why 68% of users say their models fail on state-level predictions.

Who’s Doing It Right?

Top pharma companies don’t rely on one tool. They use three: one for patents, one for FDA timelines, and one for competitive behavior. Their teams include patent attorneys, regulatory specialists, and game theory economists. Why economists? Because generic companies don’t just enter when they can. They enter when it’s most profitable. That’s a strategic decision. And it’s predictable-if you model it right. A senior forecaster at a top 10 pharma company told me their old system, based only on patent dates, overestimated entry by 11.4 months. That meant $220 million in lost revenue. They switched to Drug Patent Watch’s platform. Now they track litigation outcomes, bioequivalence risks, and authorized generics. Their forecast error dropped from 14 months to 6.8 months. Generic manufacturers are doing the same. One company saved $15 million by using dissolution testing data to avoid two failed ANDA submissions. They knew their formulation wouldn’t match the brand’s. So they didn’t waste money filing.The Bottom Line: Forecasting Is a Weapon

Predicting generic entry isn’t about being right. It’s about being right early. If you know a drug will go generic in 18 months, you can adjust pricing, shift marketing, or develop a new product. If you’re wrong, you lose billions. The best forecasts don’t come from software alone. They come from people who understand the rules, the loopholes, and the incentives. They know that a patent isn’t just a legal document-it’s a countdown clock. And every day that clock ticks, someone is working to break it. If you’re in pharma, you’re not waiting for the patent to expire. You’re watching every filing, every lawsuit, every FDA update. Because the moment the first generic enters, your drug’s value is gone. And if you didn’t prepare, you’re already behind.How long does it take for a generic drug to enter the market after patent expiration?

On average, it takes 11.4 months after patent expiration for the first generic to launch. But this varies widely-from a few weeks to over two years. Delays are caused by patent litigation, FDA approval backlogs, regulatory exclusivity extensions, and strategic moves by brand companies like product hopping or authorized generics.

What’s the difference between a generic drug and a biosimilar?

Generics are exact copies of small-molecule drugs made from chemicals. Biosimilars are similar but not identical copies of biologic drugs, which are made from living cells. Biosimilars take longer to develop (12-18 months longer), cost more to produce, and face more regulatory and clinical hurdles. Price drops are also slower-only 25-35% after three competitors, compared to 85% for small-molecule generics.

Can a brand company delay generics legally?

Yes. Brand companies use several legal tactics: filing additional patents (patent thickets), launching authorized generics, switching patients to new formulations (product hopping), filing citizen petitions with the FDA, and using REMS programs. These strategies can delay generic entry by months or even years. The Hatch-Waxman Act allows these moves, which is why forecasting requires more than just patent dates.

What role does the FDA play in generic entry?

The FDA approves all generic drugs through the ANDA process. It checks for bioequivalence-meaning the generic must deliver the same amount of drug into the bloodstream as the brand. The FDA also lists all patents and exclusivities in the Orange Book. Delays in FDA approval, especially due to staffing shortages or complex drugs, are one of the biggest reasons generics enter later than expected.

How accurate are generic entry forecasts today?

Simple models using only patent expiration dates are only 42-51% accurate. Advanced models that track litigation, FDA timelines, market size, and competitive behavior achieve 78-85% accuracy. The most sophisticated platforms, like Evaluate Pharma’s J+D Forecasting, predict first generic entry within a six-month window for small-molecule drugs. But even the best models struggle with biosimilars, authorized generics, and new tactics like the CGT pathway.

What’s the biggest mistake companies make when forecasting generic entry?

The biggest mistake is relying only on patent expiration dates. Most companies ignore litigation, regulatory exclusivity, product hopping, and authorized generics. They also overlook state substitution laws and FDA approval backlogs. This leads to forecasts that are off by 10-14 months. The result? Billions in lost revenue and no time to react.

How much does it cost to forecast generic entry accurately?

Enterprise forecasting systems cost between $250,000 and $1.2 million per year. This includes software licenses, data feeds, and staffing. Many companies hire patent attorneys, regulatory experts, and economists to interpret the data. The learning curve is 6-12 months. But for a drug with $1 billion in annual sales, the cost of being wrong can be $200 million or more.

Will AI improve generic entry forecasting?

Yes. AI models are already reducing prediction errors from 11.4 months to 6.8 months by analyzing years of FDA correspondence, patent litigation documents, and ANDA submissions. Natural language processing helps spot hidden patterns-like how certain law firms consistently win patent cases, or how specific FDA reviewers delay approvals. But AI can’t predict human behavior like pay-for-delay settlements or patient migration strategies. It’s a tool, not a crystal ball.

Shanahan Crowell

January 3, 2026 AT 09:35Wow, this is the most comprehensive breakdown I’ve ever seen on generic entry timelines-seriously, someone should turn this into a textbook! I work in pharma ops, and even I didn’t realize how many layers of delay exist beyond just patents. Product hopping? Citizen petitions? I thought those were urban legends, but now I see they’re standard operating procedure. This changes everything.

Also, the part about authorized generics? Mind. Blown. I always assumed those were just cheaper versions, not strategic sabotage. Now I get why some companies seem to ‘lose’ market share overnight but still make bank. Sneaky.

And the CGT pathway? That’s a game-changer. It’s like the FDA finally said, ‘Enough with the patent thicket nonsense.’ But I’m skeptical it’ll stick-Big Pharma’s lobbying budget could buy a small country. Still… hope is a powerful thing.

Also, why does no one talk about the FDA staffing crisis? I’ve seen ANDAs sit for 18 months because there’s literally no one left to review them. It’s not about the law-it’s about burnt-out civil servants working with 1990s software. That’s the real bottleneck.

And don’t even get me started on state substitution laws. California’s move is brilliant. Texas? Still acting like generics are ‘inferior.’ It’s not science-it’s culture. And culture takes longer to change than patents.

Thank you for this. I’ve been using a 2018 model. I’m upgrading tomorrow.

Kerry Howarth

January 3, 2026 AT 13:53Patent expiration ≠ generic launch. Always has been. Always will be.

erica yabut

January 3, 2026 AT 17:27Oh, darling, this is just the latest chapter in the grand opera of capitalist exploitation. We’ve turned medicine into a derivatives market, where the only real product is litigation. The FDA? A glorified gatekeeper for corporate chess. And the ‘authorized generic’? A velvet glove over a steel fist-brand companies stealing their own thunder while pretending to be benevolent.

Biologics are the new oil, and biosimilars are the solar panels nobody wants to install because the infrastructure’s rigged. Doctors won’t switch? Of course not-they’re paid to prescribe. Insurance won’t allow substitution? Because they’re owned by the same conglomerates that make the originals.

And let’s not forget the ‘pediatric exclusivity’ loophole-because nothing says ‘public health’ like extending a monopoly because a company tested on children. How noble. How utterly, grotesquely American.

The Inflation Reduction Act? A Band-Aid on a hemorrhage. The real solution? Nationalize pharmaceutical R&D. Let scientists work without profit motive. But no, we’d rather let hedge funds decide who lives and who dies.

This isn’t forecasting. It’s watching a funeral procession… and being asked to predict the casket’s color.

JUNE OHM

January 3, 2026 AT 18:20Okay, but who REALLY controls the FDA?? 🤔 I’ve seen videos of lobbyists in suits walking right into the building with binders labeled ‘Patent Strategy’… and then boom-generic gets delayed for 18 months. Coincidence? 😏

And the ‘authorized generic’? That’s not a business move-that’s a scam. It’s like your landlord sells your apartment to themselves at half price so you can’t afford to rent elsewhere. 🤡

Also, why is no one talking about China making the active ingredients? 🇨🇳 They control 80% of the supply chain. What if they just… stop? 🤯

And the ‘citizen petitions’? Pure blackmail. ‘Oh, this generic might cause a rash!’ (Spoiler: it doesn’t.) Then the FDA spends 7 months investigating. Meanwhile, the brand company keeps raking in cash. 😡

THIS IS A WAR. And we’re the civilians. 💥

Philip Leth

January 4, 2026 AT 18:35Man, I’m from the Midwest, and I didn’t even know this stuff existed until my cousin worked at a generics startup. He told me about how they’d spend $20 million just to file one ANDA, only to get slapped with a lawsuit and lose everything. It’s insane.

And the part about product hopping? I had a friend on Humira. They switched him to a new pen version right before generics dropped. He had to retrain on the device, got confused, started missing doses. That’s not innovation-that’s manipulation.

Also, why do we let lawyers run medicine? Shouldn’t doctors and scientists be calling the shots? I mean, I get patents protect innovation, but this? This feels like a rigged game.

And the AI thing? Cool, but if the data’s poisoned by corporate lobbying, what’s the point? Garbage in, garbage out, right?

Anyway, thanks for the deep dive. I’m sharing this with my book club. We’re gonna start a petition.

Angela Goree

January 5, 2026 AT 03:18They’re lying. All of them. The FDA, the patent offices, the drug companies-they’re all in cahoots. You think the 11.4-month delay is random? It’s calculated. Every single day. Every single filing. Every single lawsuit. It’s not incompetence-it’s collusion.

And the ‘authorized generic’? That’s not a market strategy-it’s a federal crime. The brand company is literally creating its own competition to crush the real ones. That’s market manipulation, plain and simple. And the DOJ? Silent. Why? Because they’re funded by the same lobbyists.

And don’t get me started on the Inflation Reduction Act. They’re letting Medicare negotiate prices? Please. They’ll pick the drugs that are already dying. The big moneymakers? Still protected. Always are.

They’ve turned healthcare into a casino. And we’re the suckers betting on rigged wheels.

Someone needs to expose this. Not just forecast it. EXPOSE IT.

Tiffany Channell

January 6, 2026 AT 21:21Let’s be brutally honest: 85% accuracy is still a 1-in-5 failure rate. That’s not forecasting-it’s gambling with billion-dollar outcomes. And you’re telling me these ‘advanced models’ are built by analysts who’ve never worked in a lab or talked to a pharmacist? Of course they’re wrong.

The real problem? These tools treat human behavior as data points. But doctors don’t switch because of price-they switch because their buddy at the hospital did. Patients don’t care about bioequivalence-they care if their pill looks different. And pharmacists? They follow state rules, not FDA guidelines.

And the ‘game theory’ models? Laughable. Generic companies don’t act rationally. They act emotionally. They want to be first. They want to crush the brand. They want revenge. You can’t model that with regression trees.

So no, your 6.8-month error margin is meaningless. You’re not forecasting. You’re pretending.

Neela Sharma

January 8, 2026 AT 02:00In India, we watch this with a quiet sadness. We make 60% of the world’s generics-but we are not allowed to sell them where they are needed most. The patents are not just legal barriers-they are moral ones.

Every time a drug is delayed, a child in rural Bihar goes without insulin. Every time a citizen petition stalls approval, an elderly man in Uttar Pradesh pays 10 times more for his heart medication.

It is not about innovation here. It is about survival. And the system, built in Washington, forgets that medicine is not a commodity-it is a right.

So yes, forecast the dates. But ask yourself: at what cost?

Shruti Badhwar

January 8, 2026 AT 09:49While the article provides a comprehensive technical analysis, it fundamentally overlooks the ethical implications of patent evergreening and market manipulation. The Hatch-Waxman Act was designed to balance innovation and access-but in practice, it has become a tool for monopolistic retention.

The reliance on predictive models that treat human behavior as deterministic variables ignores the sociopolitical reality: pharmaceutical access is not a market function-it is a human rights issue. When forecasting is reduced to statistical precision, we risk normalizing systemic injustice.

Moreover, the normalization of authorized generics as a ‘strategic’ move obscures the fact that it is a form of predatory pricing, designed to displace competitors without innovation.

Future forecasting frameworks must integrate equity metrics alongside patent timelines. Otherwise, we are not predicting market behavior-we are rationalizing exploitation.

Brittany Wallace

January 8, 2026 AT 17:27I just read this after my dad’s insulin went generic last year-and it hit me: we were lucky. His prescription dropped from $450 to $25 in two weeks. But I know people who waited 18 months because the brand filed a citizen petition. That’s not a delay-it’s a death sentence for some.

And the part about product hopping? My aunt got switched to a new version of her blood pressure med right before generics came out. She had no idea why her pills looked different. She stopped taking them. Ended up in the ER.

I used to think this was just business. Now I see it’s violence. Quiet, legal, bureaucratic violence.

Thank you for writing this. I’m sharing it with everyone I know. We need to stop pretending this is about science. It’s about power.

Liam Tanner

January 9, 2026 AT 12:25One thing nobody mentions: the real winners aren’t the generics or the brands-they’re the law firms. Every patent challenge, every ANDA filing, every citizen petition? That’s billable hours. And those firms have teams dedicated to just this stuff. They’re the invisible architects of the delay.

I know a guy who used to work at a BigLaw firm. He said they had a spreadsheet tracking which judges were most likely to grant stays. That’s not legal strategy. That’s game theory with a $1,000/hour price tag.

And the FDA? They’re understaffed because Congress cuts their budget every year. But they still get flooded with legal briefs from pharma lawyers. It’s not a system-it’s a trap.

Maybe the real forecast isn’t when the generic comes. It’s when we fix the system.